In the Italian banking landscape, Credem stands out as one of the most solid and reliable financial institutions. Founded in 1910, the bank has evolved over time, offering a wide range of products and services designed to meet the needs of individuals, families, and businesses. Its widespread presence across the national territory and constant focus on innovation make it a point of reference in the banking sector.

Products and Services Offered by Credem

Credem offers a complete range of financial solutions, including:

- Current Accounts: Different types of current accounts for both individuals and companies, with customizable services based on specific needs.

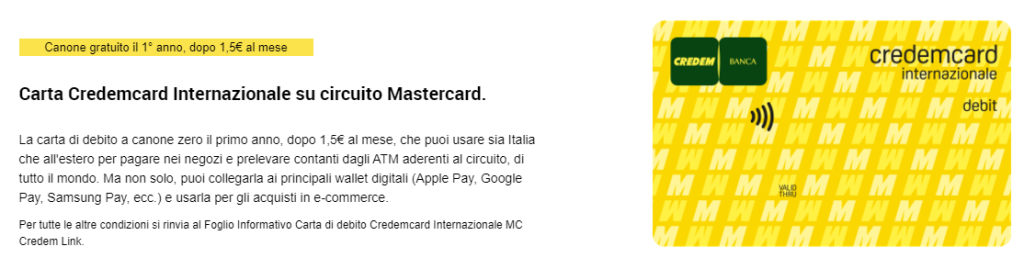

- Credit and Debit Cards: Modern and secure cards, ideal for managing daily expenses both in Italy and abroad.

- Loans and Financing: Credit solutions to realize personal projects or support business activities, with competitive rates and flexible repayment plans.

- Mortgages: Offers for purchasing the first home, second home, or for renovation, with dedicated advice and advantageous conditions.

- Investments and Savings: Diversified investment products, such as mutual funds, savings plans, and personalized financial advice to optimize asset management.

- Insurance and Pensions: Insurance policies for the protection of family, home, and health, as well as complementary pension solutions for a peaceful retirement.

- Digital Services: Online platforms and mobile apps that allow customers to independently manage their finances, make transfers, payments, and monitor transactions in real-time.

Distinctive Features of Credem

Credem is distinguished by:

- Financial Stability: Part of the Credem Group, the institution boasts a solid capital position that ensures security and reliability for customers.

- Customer Care: Dedicated customer service and financial advisors ready to offer tailored solutions for every need.

- Technological Innovation: Continuous investments in technology to offer cutting-edge digital services, facilitating access and management of one’s finances.

- Sustainability and Social Responsibility: Projects and initiatives oriented towards environmental respect and social well-being, demonstrating a strong commitment to the community.

Strategic Collaborations

Recently, Credem initiated a partnership with Worldline, a European leader in digital payments. This collaboration aims to enhance payment services for Italian merchants, offering more efficient and secure solutions. The agreement includes the management of payment activities for over 25,000 merchants and 32,000 sales points, with transactions reaching approximately 3 billion euros in 2023. The finalization of the agreement is expected next year, subject to regulatory approvals.

Conclusion

Credem represents an ideal choice for those seeking comprehensive, secure, and personalized banking solutions. Thanks to its long experience, financial solidity, and focus on innovation, the bank can offer products and services that meet the needs of a constantly evolving market. If you are looking for a reliable bank that prioritizes your financial well-being, Credem is the answer to your expectations.